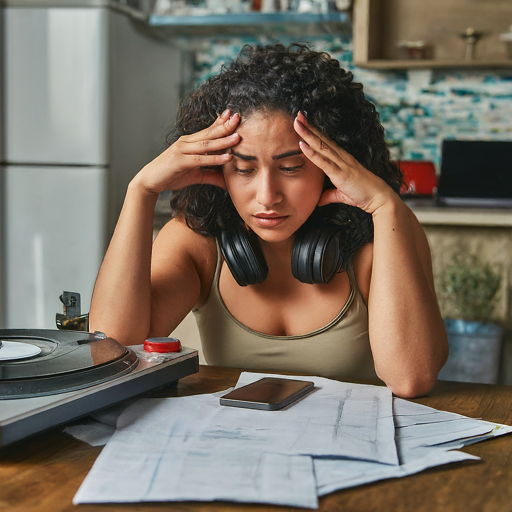

“A great DJ or mobile entertainer must entertain their crowds, but they must not overlook their own personal finances.”

By Ken Cosco

When it comes to the entertainment industry, too many people who are just starting out worry about the wrong things. A great DJ or mobile entertainer must entertain their crowds, but they must not overlook their own personal finances. Here are just a few points worth considering when merging a successful career with their personal-financial goals:

- Business owners often focus heavily on managing their businesses, sometimes neglecting their personal-financial health. However, personal finance plays a pivotal role in ensuring long-term stability and success. Challenges such as fluctuating income, tax complexities, and retirement planning require strategic attention. Pitfalls can include buying equipment because it looks cool without asking the question, “How will this item make me more money?” Another common problem is entertaining for promotion. “Promo Dollars” won’t pay the rent, the electric bill, or your insurance. If you plan on playing for a discount or for free, expect more people to come asking for the same deal. Show your worth and learn how to say, “No!”

- Separating Personal & Business Finances. Mingling personal and business finances can lead to confusion and financial instability. Establish separate bank accounts, credit cards, and accounting systems. This separation simplifies tax preparation, ensures accurate financial reporting, and protects personal assets. When at all possible, make sure to only use credit cards when you know you can pay them off in full at the end of each month. That $1,000 controller will cost you as much as $1,300 in a year if you don’t pay that credit card off in full at the end of the first month.

- Budgeting & Cash-Flow Management. Budgeting isn’t just for businesses; it’s equally vital for personal finances. Determine monthly expenses, set aside funds for savings, investments, and unforeseen expenses. Implement cash-flow-management strategies like maintaining liquidity and monitoring cash reserves. A simple challenge is to take a percentage of each check and put it into another account that doesn’t mix with your everyday bills.

- Retirement Planning. Business owners must navigate retirement planning differently from salaried individuals. Explore retirement account options such as SEP-IRAs, Solo 401(k)s, and traditional IRAs. Consider factors like contribution limits, tax advantages, and investment choices tailored to your retirement goals. For everyone that is at least 10 years from retirement, I strongly suggest a Roth IRA should be the first avenue for retirement planning.

- Tax Planning & Compliance. Understanding tax implications is crucial. Familiarize yourself with business deductions, credits, and compliance requirements. Consult with tax professionals to optimize deductions, manage quarterly payments, and stay updated on regulatory changes. Record keeping is key. Log your business miles on your personal car. Remember even if you traveled to a hardware store to buy an extension cord for your system – that is a business deduction.

- Emergency Funds & Insurance. Establishing an emergency fund safeguards against unforeseen business setbacks or personal emergencies. Additionally, prioritize insurance coverage including health, life, disability, and business-specific policies. These measures provide financial security and mitigate risks. Especially with an entertainment business, seasonality can and will hit your financial bottom line. If you are prepared with an emergency fund, you will be able to withstand those swings.

- Investment Strategies. Diversify investments beyond your business. Explore diverse asset classes such as stocks, bonds, real estate, and mutual funds. Evaluate risk tolerance, investment horizon, and financial goals to devise a balanced investment portfolio. Getting professional help when you are first starting out is advised. I recommend looking for someone that is established and is a fiduciary (i.e., a person that puts their clients’ interests ahead of their own).

- Debt Management. Effective debt management entails understanding and prioritizing debts. Consolidate high-interest debts, negotiate favorable terms, and develop a repayment strategy. Differentiate between business and personal debts, addressing each appropriately to maintain financial health. Also, you need to know the difference between “good debt” and “bad debt.” Good debt can be deducted from your taxes (e.g., mortgage interest or a portion of your car payment when that vehicle is used for business). The most common type of bad debt is credit-card debt.

- Estate Planning. Estate planning transcends business succession. Draft wills, establish trusts, and designate beneficiaries to ensure smooth asset transfer. Consult legal professionals proficient in estate planning to navigate complexities and protect assets for future generations. This is especially important if you have a spouse, children, or those that might depend on you.

Personal finance remains integral to business owners’ overall financial landscape. Embrace proactive financial management, prioritize strategic planning, and seek professional guidance when necessary. By aligning personal and business finances, entrepreneurs can achieve financial security and long-term prosperity. It can be scary to start, but all journeys begin with the first step. Tackling these challenges one step at a time will make your future brighter. In future articles, I will dive into some of the steps I took that you might want to consider.

Disclaimer: I am not a certified financial planner. I am just giving advice that has helped me over the years. I am not claiming that you will have the same success I will have. No one is perfect with financial decisions. I am not assuming any financial responsibility for your decisions.

Ken Cosco is the Chief Entertainment Officer of A Touch Of Class DJ’s in Marlborough, Mass.